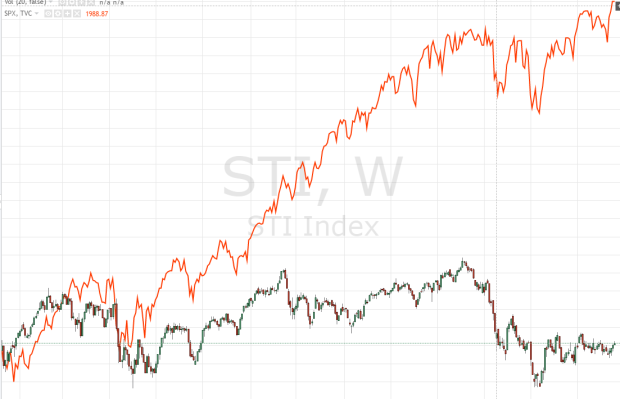

Before i started buying my first stock i was looking at ETF. ETF because i don’t how to choose stock and i am too lazy to keep following my trade. Therefore, i look at STI ETF where i can own a basket of top Singapore companies. At that time STI was 3300-3400 range. Being a son of a business man, after listening to all my dad’s stories, I felt that there was a lack of potential in future growth in Singapore. Hence i venture into other countries. I was looking at Japan, Australia and USA. Then i came to a conclusion US was the best. Look at the chart below, Candle stick is STI and orange line is S&P 500, ignore the numbers for once just look at the overall picture. Who will you buy? S&P 500 la!

However from the chart above, some might felt that S&P 500 is overvalued, growth is unsustainable. If recession come all die, at least 50% down. All my friends never invest one all keep telling me recession coming, I now go in i also scared, so i when to look for defensive stock. This is where i come across Berkshire Hathaway.

Candle stick is BRK, Blue line is S&P 500.

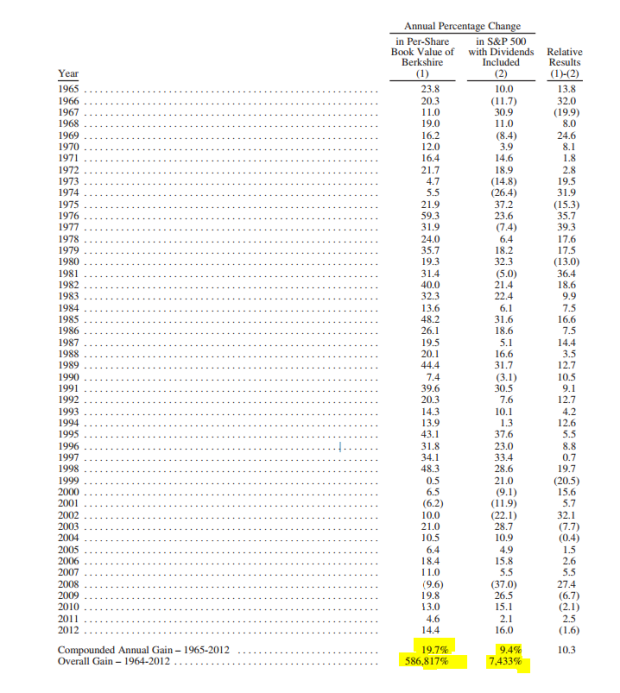

So its clear that BRK > S&P500 > STI

Now i just need to ensure i enter at a good exchange rate and buy BRK Dip. I know i can’t trade like buffet, so i just buy buffet. In addition, BRK don’t give dividend, so can avoid the 30% dividend tax in US. Very good for Singaporean!

Below is a publication from Berkshire annual report. Imagine last time your ah gong ah ma put $10 in Berkshire in 1965, now you got 5 million dollar go buy 5 small condo and still got money change Rolex every year.

PS: This is just my honest review, Don’t later lose money come find me.

Warren Buffet also wear Rolex ok! Mai Siao Siao!